Wasaga may be following in Collingwood's footsteps with a tourist tax (MAT)Between 2016 and 2021, the town's population swelled by 20%, reaching over 24,000 residents. But as the waves roll in, so do the challenges of maintaining and enhancing this beloved destination. Enter the buzzworthy topic of the day: the Municipal Accommodation Tax (MAT). Collingwood introduced their just a few months ago and unless enough peopel speak up against it, it's likely to come to our shores next. ...but maybe that's a good thing?

Quick Summary

Wasaga Beach is considering implementing a 4% Municipal Accommodation Tax (MAT) on short-term stays of 30 days or less to support tourism and infrastructure. The town’s population grew by 20% between 2016 and 2021, reaching over 24,000 residents. In June 2024, the council adopted a Tourism Destination Management Plan, and by August 2024, public consultations on the MAT began. At least 50% of MAT revenue must go to a not-for-profit tourism entity, with the rest allocated to municipal projects. Over 40 Ontario municipalities, including Collingwood and The Blue Mountains, have already implemented MATs, and Toronto raised its rate from 4% to 6% in May 2023. Local business owners have mixed reactions—some worry about added costs, while others see long-term benefits. Residents and stakeholders can provide input via the town’s survey at www.engagewasaga.ca/mat.

What Exactly is a MAT?

Picture this: every time a visitor books a cozy bed-and-breakfast or a chic motel room in town, a tiny portion of that bill goes towards a fund dedicated to boosting local tourism and infrastructure. That's the essence of the MAT—a tax applied to short-term accommodations, typically those lasting 30 days or less. In Ontario, many municipalities have embraced this initiative, with rates often set at 4%.

Why is Wasaga Beach Considering This Now?

Great question! In June 2024, Wasaga Beach's council adopted the Tourism Destination Management Plan, highlighting the MAT as a pivotal tool for sustainable tourism growth. By August 2024, the council greenlit public consultations to delve deeper into this prospect. The goal? To ensure that as more flip-flops hit the sand, the town's charm and infrastructure keep pace.

Show Me the Money: How Would MAT Funds Be Used?

Ontario's guidelines stipulate that at least 50% of the net MAT revenue must be channeled to a not-for-profit tourism entity. This ensures that a significant portion of the funds generated from visitors is reinvested into promoting and developing local tourism, which can lead to increased visitation and economic benefits for the community. The remaining funds are at the municipality's discretion, often earmarked for projects that enhance both resident and visitor experiences. Think upgraded trails, spruced-up parks, or even that new community center everyone's been chatting about.

Who's Picking Up the Tab?

The MAT is designed to be a visitor-centric tax. It applies to stays of 30 days or less in accommodations like hotels, motels, bed and breakfasts, and short-term rentals (think Airbnb or VRBO). However, not all lodgings are on the hook. Exemptions typically include hospitals, post-secondary dormitories, and shelters. So, if Aunt Mildred comes to town and crashes on your couch for a week, rest easy—no tax there!

Learning from the Neighbors: MAT in Action Elsewhere

Wasaga Beach isn't venturing into uncharted waters. Nearby communities like The Blue Mountains and Collingwood have already rolled out their own MAT programs. In fact, over 40 municipalities across Ontario have adopted this tax, each tailoring it to their unique needs. For instance, Toronto bumped its MAT rate from 4% to 6% in May 2023, aiming to bolster its tourism coffers even further.

A Small Business Perspective: How MAT Impacts Local Accommodations

For local business owners, the MAT is a mixed bag. Some see it as a necessary step in maintaining and improving the town's tourist appeal, while others worry about the added costs and administrative burden.

Take Sarah, for example, who runs a 12-room family-owned motel along the beachfront. "We already operate on tight margins," she explains. "A 4% tax might not seem like much, but when you factor in seasonal slowdowns and rising operational costs, it adds up. We might have to adjust our pricing or absorb some of the cost ourselves."

Similarly, Mark and his wife Lisa, who rent out their basement apartment through Airbnb, are concerned about the paperwork. "We love hosting guests, but we're not a big hotel chain with an accounting team. If the process isn't straightforward, it could become a real hassle for small operators like us."

On the flip side, some business owners see an upside. "If this tax truly funds tourism promotion and infrastructure, it could bring in even more visitors," says Tom, the manager of a mid-sized inn. "In the long run, that could benefit all of us. But it depends on how the town manages the funds."

Ultimately, the success of the MAT hinges on clear implementation guidelines and ensuring small businesses aren’t left struggling with red tape.

Your Voice Matters

Wasaga Beach's leadership is all about community input. They've launched a survey to gather thoughts, concerns, and ideas from residents, businesses, and stakeholders. The feedback will play a crucial role in shaping the MAT's structure, governance, and implementation. To chime in, head over to the town's official engagement platform at engagewasaga.ca/mat. Your insights could help steer the future of tourism and economic development in our beachy backyard.

The MAT discussion is part of a larger tapestry of initiatives aimed at propelling Wasaga Beach forward. The town is exploring the establishment of a Municipal Service Corporation (MSC) aptly named "Build Wasaga." This entity's mission? To maximize the value of beachfront properties, ensuring both financial returns and enhanced community spaces. Residents are encouraged to dive into the details and share their thoughts on this venture as well. On balance, the changes are likely good - maybe even very good - for Wasaga. One thing is for sure; the satus quo wasn't.

Got a question?

Between 2016 and 2021, the town's population swelled by 20%, reaching over 24,000 residents. But as the waves roll in, so do the challenges of maintaining and enhancing this beloved destination. Enter the buzzworthy topic of the day: the Municipal Accommodation Tax (MAT). Collingwood introduced their just a few months ago and unless enough peopel speak up against it, it's likely to come to our shores next. ...but maybe that's a good thing?

Quick Summary

Wasaga Beach is considering implementing a 4% Municipal Accommodation Tax (MAT) on short-term stays of 30 days or less to support tourism and infrastructure. The town’s population grew by 20% between 2016 and 2021, reaching over 24,000 residents. In June 2024, the council adopted a Tourism Destination Management Plan, and by August 2024, public consultations on the MAT began. At least 50% of MAT revenue must go to a not-for-profit tourism entity, with the rest allocated to municipal projects. Over 40 Ontario municipalities, including Collingwood and The Blue Mountains, have already implemented MATs, and Toronto raised its rate from 4% to 6% in May 2023. Local business owners have mixed reactions—some worry about added costs, while others see long-term benefits. Residents and stakeholders can provide input via the town’s survey at www.engagewasaga.ca/mat.

What Exactly is a MAT?

Picture this: every time a visitor books a cozy bed-and-breakfast or a chic motel room in town, a tiny portion of that bill goes towards a fund dedicated to boosting local tourism and infrastructure. That's the essence of the MAT—a tax applied to short-term accommodations, typically those lasting 30 days or less. In Ontario, many municipalities have embraced this initiative, with rates often set at 4%.

Why is Wasaga Beach Considering This Now?

Great question! In June 2024, Wasaga Beach's council adopted the Tourism Destination Management Plan, highlighting the MAT as a pivotal tool for sustainable tourism growth. By August 2024, the council greenlit public consultations to delve deeper into this prospect. The goal? To ensure that as more flip-flops hit the sand, the town's charm and infrastructure keep pace.

Show Me the Money: How Would MAT Funds Be Used?

Ontario's guidelines stipulate that at least 50% of the net MAT revenue must be channeled to a not-for-profit tourism entity. This ensures that a significant portion of the funds generated from visitors is reinvested into promoting and developing local tourism, which can lead to increased visitation and economic benefits for the community. The remaining funds are at the municipality's discretion, often earmarked for projects that enhance both resident and visitor experiences. Think upgraded trails, spruced-up parks, or even that new community center everyone's been chatting about.

Who's Picking Up the Tab?

The MAT is designed to be a visitor-centric tax. It applies to stays of 30 days or less in accommodations like hotels, motels, bed and breakfasts, and short-term rentals (think Airbnb or VRBO). However, not all lodgings are on the hook. Exemptions typically include hospitals, post-secondary dormitories, and shelters. So, if Aunt Mildred comes to town and crashes on your couch for a week, rest easy—no tax there!

Learning from the Neighbors: MAT in Action Elsewhere

Wasaga Beach isn't venturing into uncharted waters. Nearby communities like The Blue Mountains and Collingwood have already rolled out their own MAT programs. In fact, over 40 municipalities across Ontario have adopted this tax, each tailoring it to their unique needs. For instance, Toronto bumped its MAT rate from 4% to 6% in May 2023, aiming to bolster its tourism coffers even further.

A Small Business Perspective: How MAT Impacts Local Accommodations

For local business owners, the MAT is a mixed bag. Some see it as a necessary step in maintaining and improving the town's tourist appeal, while others worry about the added costs and administrative burden.

Take Sarah, for example, who runs a 12-room family-owned motel along the beachfront. "We already operate on tight margins," she explains. "A 4% tax might not seem like much, but when you factor in seasonal slowdowns and rising operational costs, it adds up. We might have to adjust our pricing or absorb some of the cost ourselves."

Similarly, Mark and his wife Lisa, who rent out their basement apartment through Airbnb, are concerned about the paperwork. "We love hosting guests, but we're not a big hotel chain with an accounting team. If the process isn't straightforward, it could become a real hassle for small operators like us."

On the flip side, some business owners see an upside. "If this tax truly funds tourism promotion and infrastructure, it could bring in even more visitors," says Tom, the manager of a mid-sized inn. "In the long run, that could benefit all of us. But it depends on how the town manages the funds."

Ultimately, the success of the MAT hinges on clear implementation guidelines and ensuring small businesses aren’t left struggling with red tape.

Your Voice Matters

Wasaga Beach's leadership is all about community input. They've launched a survey to gather thoughts, concerns, and ideas from residents, businesses, and stakeholders. The feedback will play a crucial role in shaping the MAT's structure, governance, and implementation. To chime in, head over to the town's official engagement platform at engagewasaga.ca/mat. Your insights could help steer the future of tourism and economic development in our beachy backyard.

The MAT discussion is part of a larger tapestry of initiatives aimed at propelling Wasaga Beach forward. The town is exploring the establishment of a Municipal Service Corporation (MSC) aptly named "Build Wasaga." This entity's mission? To maximize the value of beachfront properties, ensuring both financial returns and enhanced community spaces. Residents are encouraged to dive into the details and share their thoughts on this venture as well. On balance, the changes are likely good - maybe even very good - for Wasaga. One thing is for sure; the satus quo wasn't.

Got a question?

Wasaga Beach Goes High-Tech: Self-Cleaning Toilets and a Bigger Beachfront Vision

Wasaga is stepping into the future — and it's starting with the washrooms! Wasaga has now…

Spend Your Summer Building Dreams: Collingwood’s Student Summer Ventures Program

If you’re a student around Collingwood or Wasaga Beach with a killer business idea, this summer…

What's That Buzz Overhead?

If you've noticed helicopters slicing through the skies and watercraft zipping across Georgian Bay…

Main Street Makeover: Wasaga Beach's Property Puzzle

In the heart of Wasaga Beach, Main Street boasts properties central to the town's redevelopment…

The Bed and Breakfast Buzz in Wasaga Beach: Garden Suites

Wasaga Beach, renowned for its 14-kilometer stretch as the world's longest freshwater beach, isn't…

Yay, Wasaga & Collingwood didn't make the top 20 - for flood-prone cities in Ontario

While we up here in Wasaga and Collingwood might be breathing a sigh of relief for not topping…

It's official! Sunray Group is bringing a hotel to Beach Area 1

The Town of Wasaga Beach inked the long-anticipated deal with the award-winning Sunray Group of…

Pickleball Party in Collingwood: Six New Courts Coming Soon!

Collingwood is about to get a whole lot more "dill-ightful" with the construction of six brand-new…

Craig's Cookies: Celebrating a Sweet Year in Collingwood

Craig's Cookies, nestled at 66 Hurontario Street in Collingwood, is celebrating its first…

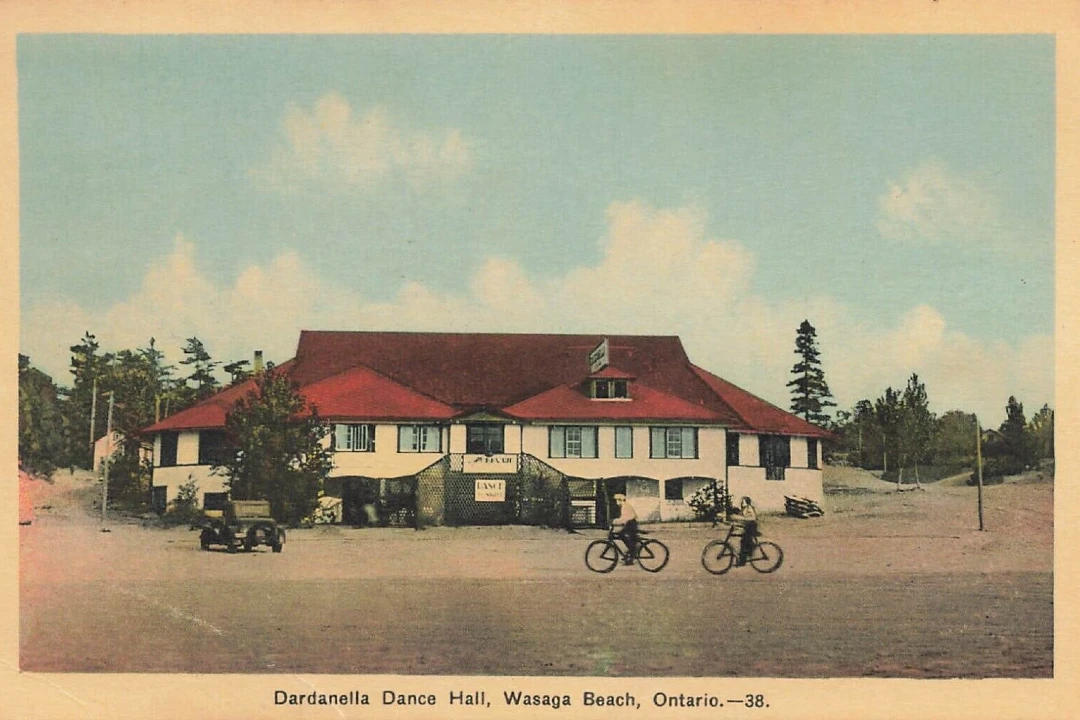

Goodbye to "The Dard": heartbeat of countless summers

The Dardanella — affectionately known as "The Dard" — has been a beacon of music, dance, and…